Journal of Accountancy,

August 2014 Excel Reader Challenge

Summary of Reader Solutions by J. Carlton Collins

You can download Amir’s

solution at www.CarltonCollins.com/amir.xlsx.

Many readers, including myself, had trouble using Excel’s Solver because

this tool is limited, as follows:

In Excel Solver, the number of variables is

limited to 200, and the number of constraints you can apply to

non-decision variables is limited to approximately 100 (depending on

whether you use a linear or nonlinear model) and the specific

configuration of the constraints.

I got around these

limitations by dividing my solution up into 4 solver calculations, each

solving one quarter of the entire problem, and then combining the

results.

Amir ingeniously got around this

problem by creating calculations that simplified the problem into a 52

week numbers problem, expressed as integers.

(In contrast, I solved for both

the ticker and buy/sell date combinations, which resulted in more much

computing power than Excel Solver could handle. Amir used calculations

to reduce the ticker and date combinations down to just 52 weeks, and

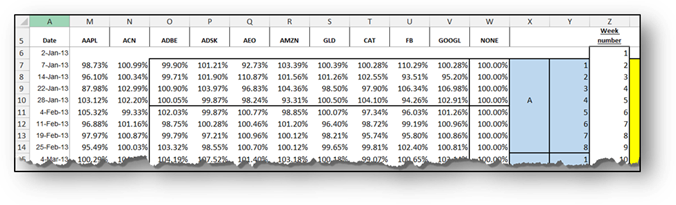

Solver was able to handle this simplified approach.) You can see

where Amir accomplished this in the screenshot below – he calculated the

weekly returns in columns M thru

V, and then assigned a week number to each week in

column Z.

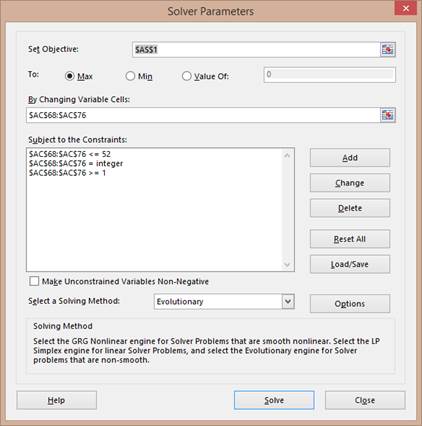

Thereafter, he used

Solver to identify the specific 10 combinations of the 52 weeks that

would derive the top solution. The simplicity of this “week number”

approach can be seen in the following screenshot of Amir’s

Solver Parameters.

Amir’s

Objective cell (AS1 in this

example), was simply the product of the 10 weekly returns flushed out by

his calculations – Solver then calculated the many different combinations of

these weekly returns to maximize this amount.

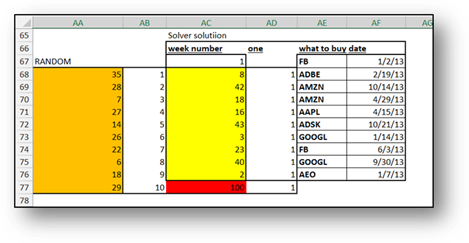

Amir’s

first and third constraints

listed above (AC68:AC76<=52

and AC68:AC76>=1) simply

limited each of the ten week digits flushed out by his calculations to the

digits 1 to 52, as pictured in yellow below.

Amir’s

second constraint listed

above (AC68:AC76=integer)

limited these yellow cells to integers, so Solver would not attempt to

solver for fractional amounts.

I learned from this challenge that Excel’s solver

is limited, I was not aware of these specific limitations, although I

did understand that billions of calculations can overwhelm Solver.

Further, Amir’s solution helped me understand that Solver works best

when you can reduce your problem down to a simple series of integers. I

also learned that if you reached the limit of 100 constraints, you may

be able to overcome this obstacle by using the following steps:

1.

If you have

constraint cells containing simple formulas, such as =A1 (where A1 is a

decision variable), then these cells count against the limit of 100; but

if you apply the constraint directly to the decision variable cells

themselves, it won't.

2.

If a constraint

involves two or more decision variables, it might be helpful to place

individual limits on these variables instead.

3.

If you have

formula based constraints calculated into your worksheet, whose values

depend on the decision variables, then Solver treats them against the

constraint limit, even if they are decision variables. In this case, you

should replace these formula based constraints with individual cell

limits, if possible.

4.

If all else

fails, an excellent option may be to upgrade to Frontline's Premium

Solver Pro which has a limit of 1,000 constraints for linear problems,

and 250 constraints for nonlinear problems (apart from bounds on the

variables and integer constraints), and it can solve problems faster

than Excel Solver. In addition, Frontline’s Large-Scale GRG Solver

handles problems with thousands of constraints, in addition to bounds on

the variables. You can download a free 15 day trial of these Excel

add-in solutions at www.solver.com,

as pictured below.

I downloaded Frontline’s Premium Solver Pro and added it in to Excel and then used this solution, here is the solution’s ribbon toolbar.

I was particularly pleased that Frontline’s

Premium Solver Pro automatically detected and picked up the parameter

settings from Excel Solver, so I did not have to re-create them from

scratch.

I had always visualized

this challenge as a problem for Excel Solver, but some readers took

different approaches to solving this problem, a few of which are briefly

mentioned below:

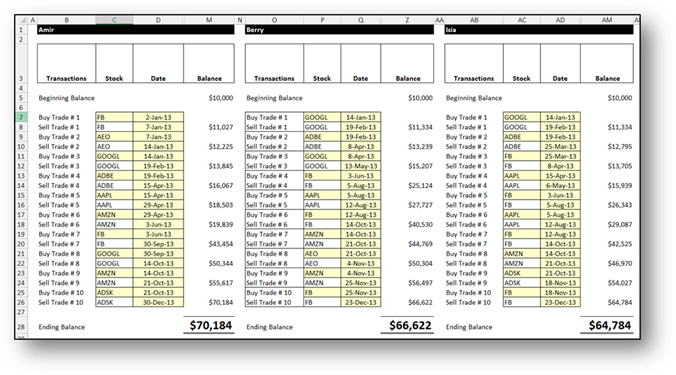

1.

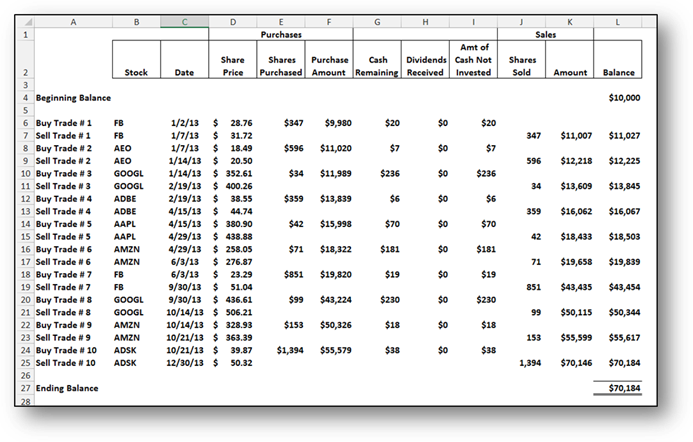

Amir ($70,184) – As

discussed above, Amir used the

Solver approach to derive a maximum portfolio of $70,184.

2.

Berry ($66,622) – Berry’s

solution utilizes a series of

MAX functions to flush out the maximum gains for each holding

period, and then the MATCH

function to extract the corresponding date and ticker information for

those MAX gains.

3.

Isai ($64,784) – Isia used

an Array Formula approach to

derive a maximum portfolio value of $64,784.

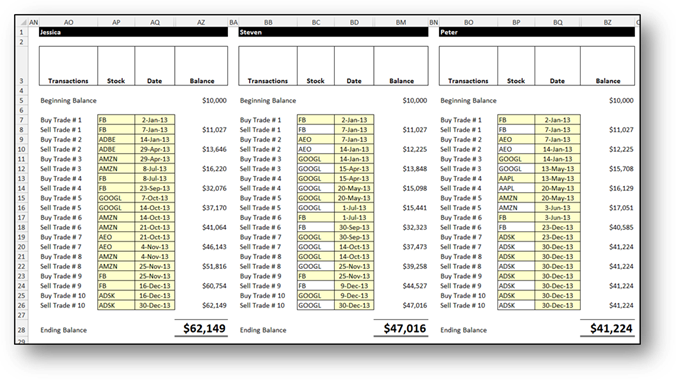

4.

Jessica

($62,149) – Jessica

calculated the XIRR for each

weekly trade for all stocks, and then extracted the highest 10 trades.

5.

Peter ($41,224) – Peter used

a LOOKUP, Formula, Sorting

and Filter approach to

derive a maximum portfolio of $41,224.

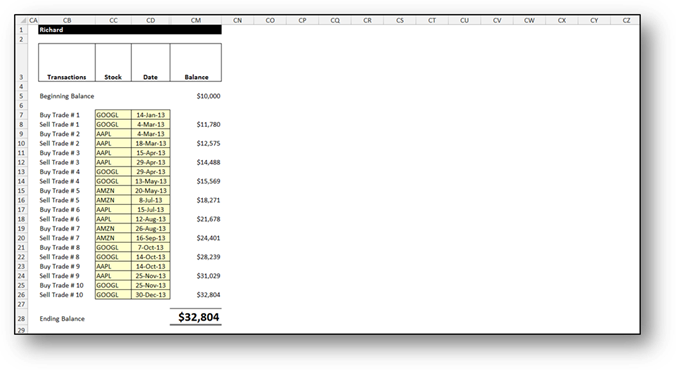

6.

Richard

($32,804) – Richard’s

solution derived a maximum portfolio value of $32,804 by calculating the

differences between the MIN and

MAX prices for each stock, and then eyeballing (apparently) the

results to pluck out the top trades.

Many readers indicated that they struggled with

this challenge and ultimately, many of them simply gave up. Kudos to

those readers who accepted the challenge, and put forth the effort to

submit a solution – you represent the cream of the crop.

Congratulations.